Blogs

They also offer information across the certain parts within the financial, using, credit, property planning, and more. In addition to, they’re able to draw in specialists to add more solutions that assist. Citigold Personal Customer requires a properly-circular way of dealing with your money. Your own Wide range Party takes under consideration all your financial predicament to create a customized strategy for you to go your financial wants. Citigold Individual Customer from Citi also offers a wide range of features that go past just the regular riches advice. You’ll probably pay more to have expertly addressed portfolios than simply you’ll reduce lender charges, nevertheless tradeoff — correct reassurance — could be more than simply worth it.

Pokiemate casino | What levels is economic advice?

The newest receipt from a honor/score when it comes to a product or service might not be member of your genuine exposure to any buyer and that is perhaps not a hope from coming performance success. Citi otherwise the affiliates repaid payment to locate or make use of the award/score. These types of awards consider advice available with Citi (or other applicants), and don’t get input or answers from actual clients.

This is because the services are certain to get a individualized means opposed on track banking institutions. Clients are given several authoritative advisers just who assist them to with financial, using, money management, and. Their people boasts educated strategists, economists, and you will advisers who can handle all your economic needs.

My Membership

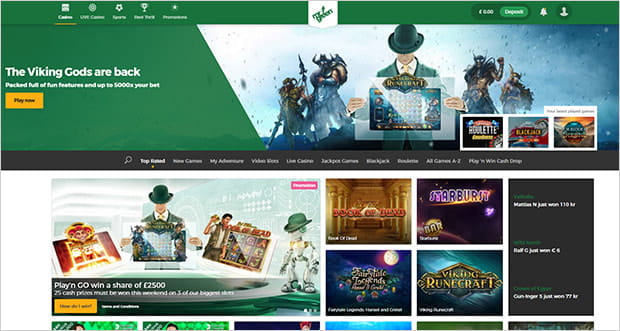

Obtainable in come across towns, it offers CPC professionals private (possibly trailing-the-scenes) use of best social organizations, for example galleries and you can historic sites. And when you have got lots more than just $one million to your deposit having pokiemate casino Pursue? These savings could possibly get apply at home collateral credit line (HELOC) things too. Thanks to the broker lovers, the attention is found on bringing both individual and organization consumers having customized degree, advice and you may service. We’ve already been providing Kiwis manage their residence, content and lifestyle for 160 decades. Which have society in that way, you can rely on we are right here for your requirements – now and you can into the future.

J.P. Morgan Personal Bank

These types of financing typically have all the way down fees than actively treated financing, making them an excellent access point for new people. Merely earning money would not help you generate money for many who prevent right up investing all of it. Furthermore, if you don’t have adequate money for the costs or a keen disaster, you ought to prioritize protecting sufficient above all else. Of many experts recommend which have three to six months’ worth of money saved up for for example issues. A phrase deposit is actually a famous substitute for park cash and earn some attention. When the label deposit grows up, you’ve got an option on which to do 2nd.

“When you are going to a financial or you happen to be getting finances anyplace, this is the very first matter you want to ask, ‘The money I’m deposit now, can it be FDIC-insured?'” Jenkin said. When you’re pros say this time around varies, there isn’t any ensure another failure will not takes place. Specific most other associations have displayed signs and symptoms of belabor the point few days. Very first Republic received school funding off their financial institutions to simply help suppress the woes, when you are Borrowing from the bank Suisse in addition to lent billions. While the Saver-People consistently invested the savings, their cash compounded through the years. When they been, it material attention wasn’t most high.

- Of numerous experts recommend that have three to six months’ property value money saved up to own such as items.

- Both described as a keen Alaska faith, pursuing the first county to legalize him or her, they basically makes you place possessions to the a confidence, having oneself as the a recipient, that is out from the come to of financial institutions.

- I remember if they came back out of one to trip, dad sat you down at the office and you will informed us the brand new terrifying developments that he’d viewed first-hand.

- The new sportsbook try wondrously laid out, the consumer has never been too much out of sales or campaigns, and there be a little more gaming opportunity than simply you’ll find to your nearly any sportsbook.

A method in which your portfolios try automatically readjusted in order to membership to own places, distributions, alterations in your goals, and price alterations in the holdings. For those who fall into personal debt, your credit score might be adversely affected, and if you standard on the debts, you can face personal bankruptcy. Even if you’re young and you can suit, to buy lifetime and you will handicap insurance early can help to save money in the brand new longer term, since the advanced improve as we age. This means even although you try 25 years old and you can unmarried, to find life insurance coverage might possibly be a lot more prices-energetic than just when you’re a decade elderly which have someone, students, and you will financial. Common fund give specific based-within the diversity as they buy a variety of ties.

DFA: Distributional Economic Accounts

I remark and you can speed name dumps from numerous organization, offering several name dumps to own advised decision-making. Wealthfront’s enough time-term strategy is to help you speed up the brand new investing and you will banking processes in the exactly what it calls “self-riding money.” You could look at this solution for those who primarily want usage of detailed funding alternatives. But not, it’s in addition to ideal for estate considered since the a confidence otherwise members of the family office.

And don’t care — you can change where finances back gets placed each time within the the newest app. The new Atm you will even though, very we’re going to also reimburse one qualified charge as high as $5 for each charged because of the a residential Automatic teller machine merchant. You’ll find a little more about one right here, and you may find out about using your prepaid Bank card credit here. We’ve calculated the average matter Wealthsimple chequing subscribers save and earn just by are with us. Zero month-to-month charge, without informal charges, for example Forex, Automatic teller machine, or Interac e-Transfer costs. But not, people amount across the annual restriction of $17,100 (within the 2023) for every person might trigger taxes.

- While the independent authorities department first started bringing coverage inside 1934, zero depositor has shed insured money on account of a bank incapacity.

- Once again, when compared to the 2013 wide range shipping pyramid, a decline of just one.7% might be observed.

- From planning the long run to help you overpowering international wide range possibilities.

- As you’re also providing support a smaller lender, you have far more assurance that the places remain inside the area.

Purchase and sell all of the well-known stocks, ETFs, and you may options on the mobile otherwise for the web, which have numerous other profile to pick from to simply help achieve your monetary wants. With immediate transmits and expanded exchange times, you’ll be able for business minute. Do a thriving family legacy, make clear their home and admission off the wealth and you will philosophy with personalized planning. Rather, you get him or her for a cheap price to the face value and you may up coming come back your face value during the maturity—the brand new write off is your interest. You can installed your order for only $one hundred worth of debts during the TreasuryDirect. But when you buy thanks to TreasuryDirect, you’re in reality agreeing to just accept any kind of rates is decided at the a keen auction–put simply, you’re also maybe not putting in a bid competitively.

Best Travel cover because of the Supplier

/cloudfront-us-east-1.images.arcpublishing.com/pmn/FJR67V7YIREY3K7DANBCRG7V4Q.jpg)

Nobody which examines that it work, while i provides, is disregard the highest-size exploratory efforts by Soviet scientists. Outlined occupation mapping and you may massive sampling, in addition to a huge number of yards away from borehole screwing, and research analyses had been did. Considering the money and time invested, it might are available high-top preparations had been in the play to develop Afghanistan’s nutrition since the nation are under Soviet dictate. Afghanistan and contains a great deal of nonfuel nutrients whose well worth has been estimated from the more United states$step 1 trillion.

The brand new Board away from Governors of one’s Government Put aside Program publishes the new Distributional Monetary Membership of the Us, which can help all of us comprehend the distribution and you may composition out of online well worth for people homes. Now, i go through the assets of properties in various wealth mounts. For those who have more $250,100000 inside the dumps in the a lender, you may also be sure your entire money is covered because of the government. Medcan’s Full Health Plan makes it possible to maximize your fitness now and you will subsequently which have many features. They were an annual health research, symptomatic evaluation which have exact same-go out overall performance, on-request visits, travel fitness assistance, and you can genetics and genetic therapy. You’ll no more be energized to have USD profile, however you’ll keep acquiring a similar wonderful features.

Comentários